Bookkeeping

Gearing Ratios: Definition, Types of Ratios, and How to Calculate

Conversely, the equity ratio is equal to total equity divided by total assets. The formula for the debt-to-equity ratio is equal to total debt divided by total equity. It’s also worth considering that well-established companies might be able to pay off their debt by issuing equity if needed. In other words, having debt on their balance sheet might be a strategic business decision since it might mean less equity financing. Fewer shares outstanding can result in less share dilution and potentially lead to an elevated stock price.

What is your current financial priority?

A business can create a capital structure that strikes a balance between its demand for funding and its tolerance for financial risk by examining various situations and how they affect th ratio. Gearing ratios are also a convenient way for the company itself to manage its debt levels, predict future cash flow and monitor its leverage. Lenders rely on gearing ratios to determine if a potential borrower is capable of servicing periodic interest expense payments and repaying debt principal without defaulting on their obligations.

- It’s important to compare the net gearing ratios of competing companies—that is, companies that operate within the same industry.

- This is because the gearing ratio could reflect a risky financial structure, but not necessarily a poor financial state.

- The input shaft and output shaft are connected by the intermediate shaft.

- Sometimes, the business obtains a loan to finance the losses and maintain working capital.

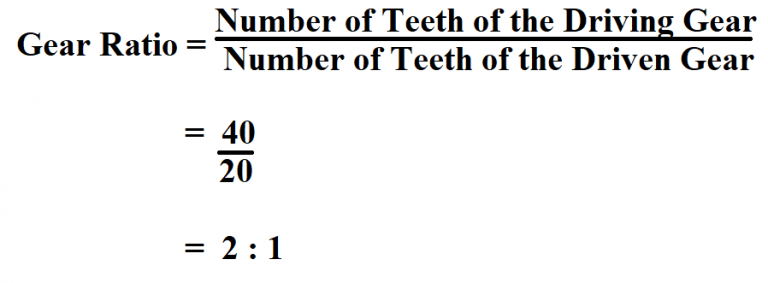

- There are several methods to calculate it, but the most common is the debt-to-equity ratio.

What Is the Gearing Level?

Hence, companies attempt to identify their optimal capital structure, the proportion of debt and equity at which its weighted average cost of capital is minimum. The gearing ratio tells a company its current proportion of debt in its capital structure. Financial analysts commonly use the gearing ratio to understand the company’s overall capital structure by dividing total debt into total equity.

thoughts on “What Is Gear Ratio? It’s Formula and Calculation on Gear Ratio”

Therefore, gearing ratios are not a comprehensive measure of a business’s health and are just a fraction of the full picture. Make sure to use gearing ratios as part of your fundamental analysis, but not as a standalone measure and always utilise the ratios on a case-by-case basis. On the other hand, the how to prioritize risks with risk registers in an operations management project risk of being highly leveraged works well during good economic times, as all of the excess cash flows accrue to shareholders once the debt has been paid down. Let’s say a company is in debt by a total of $2 billion and currently hold $1 billion in shareholder equity – the gearing ratio is 2, or 200%.

Price to Sales Ratio: A Key Metric for Understanding Company Value

Instead of looking at just total debt, the net gearing ratio subtracts cash and liquid assets from total debt, giving a clearer picture of a company’s actual leverage. Calculating the gearing ratio involves comparing the company’s debt to its equity. There are several methods to calculate it, but the most common is the debt-to-equity ratio. Again, the business’s total assets exceed the total equity, which means the business has financed the purchase of assets with equity. So, the business indicates better financing and investing environment with long-term solvency.

Thus, hindering growth is more of a hindrance to the company’s development. In addition, there are other formulas where the owner’s capital or equity compare against the long-term or short-term debt. The result indicates its financial leverage or how much of its operational debt is serviced via shareholders’ equity and/or borrowed funds.

In cases where a lender would be offering an unsecured loan, the gearing ratio could include information about the presence of senior lenders and preferred stockholders, who have certain payment guarantees. This allows the lender to adjust the calculation to reflect the higher level of risk than would be present with a secured loan. A gearing ratio is a useful measure for the financial institutions that issue loans, because it can be used as a guideline for risk.

A gearing ratio is a measure used by investors to establish a company’s financial leverage. In this context, leverage is the amount of funds acquired through creditor loans – or debt – compared to the funds acquired through equity capital. Debt ratio is very similar to the debt to equity ratio, but as an alternative, it measures total debt against total assets. This ratio provides a measure to which degree a business’s assets are financed by debt.

A gearing ratio is a measurement of a company’s financial leverage, or the amount of business funding that comes from borrowed methods (lenders) versus company owners (shareholders). Well-known gearing ratios include debt-to-equity, debt-to-capital and debt-service ratios. Let’s interpret the gearing status of the business with the calculation of related gearing ratios like debt to equity, time interest earned, debt ratio, and the equity ratio. The most common approach for estimating the gearing ratio is utilizing the debt-to-equity ratio, i.e., a company’s debt divided by its shareholders’ equity.

- Narcos: Year Thrills casino step one

- Unser 10 besten Verbunden Casinos über schneller Ausschüttung 2025

- $5 Minimal Put hot seven online Casinos United states Gambling enterprises with $5 Put 2025

- A knowledgeable fifty Free Loki 50 free spins no deposit bonus 2024 Spins No deposit Extra in the 2025

- Zeker en lonend offlin speculeren met Wizebets Black Diamond casino Gokhal

Bài viết cùng chủ đề:

-

The difference between the periodic and perpetual inventory systems

-

Cash Flow Statement: Operating, Investing & Financing Activities

-

How Salvage Value Is Used in Depreciation Calculations

-

What Is Salvage Value in Accounting and How Is It Calculated?

-

What is Fund Accounting? A Nonprofit’s Guide

-

How to Comply with Accounting Standards for Nonprofits

-

Liability: Definition, Types, Example, and Assets vs Liabilities

-

All About Liabilities: Meaning, Types and Examples

-

California Overtime Law 2025: All You Need to Know

-

Accounting Explained With Brief History and Modern Job Requirements

-

Contribution Margin Formula + Calculator

-

Contribution Margin: Definition, Overview, and How To Calculate Online Business School

-

What is Prepaid Insurance: Benefits and Examples Order to Cash Knowledge Center

-

Prepaid Expenses: Definition, Examples & How to Record

-

Cash Basis vs Accrual Accounting: Which Method Is Right for Your Business? PW Associates, CPAs

-

Cash Basis of Accounting: Definition, Example & Key Differences