Bookkeeping

Gearing Ratio: Formula, Calculation, And more

Nathalie combines analytical thinking with a passion for writing to make complex financial topics accessible and engaging for readers.

Interpreting Gearing Ratios

This is especially true when interest rates are low and the business enjoys healthy and predictable cash flows. A company whose CWFR is in excess of 60% of the total capital employed is said to be highly geared. This is shown by the fact that the common stockholders’ equity exceeds the fixed cost bearing funds (total of preferred stock and bonds).

Gearing Ratio vs. Debt Ratio

So, investors should think before investing about the small line gap between the impact of gearing and the conversion to loss. Sometimes, the business obtains a loan to finance the losses and maintain working capital. Similarly, businesses sometimes finance growth/expansion with the loan obtained. Furthermore, companies can negotiate with their lenders to convert any existing debt into equity shares.

Good/Bad: What Is a Good Leverage & Gearing Ratio?

Loan agreements may also require companies to operate within specified guidelines regarding acceptable gearing ratio calculations. Internal management uses gearing ratios to analyze future cash flows and leverage. The debt ratio compares the business’s total debt with the total assets. It helps to understand if the loan obtained has been used to finance the purchase of assets.

Debt ratio

Usually, where high investment is involved, gearing ratios tend to be higher as they have to afford those. Usually, where high investment is involved, gearing ratios tend to be higher as they have to afford those CapEx via externally secured fundings. A gearing ratio of 0.5 means that the company has $0.50 of debt for every dollar of equity, suggesting moderate financial leverage. This balance indicates that the company uses debt responsibly to finance its operations without taking on excessive financial risk. Financial institutions use gearing ratio calculations when they’re deciding whether to issue loans.

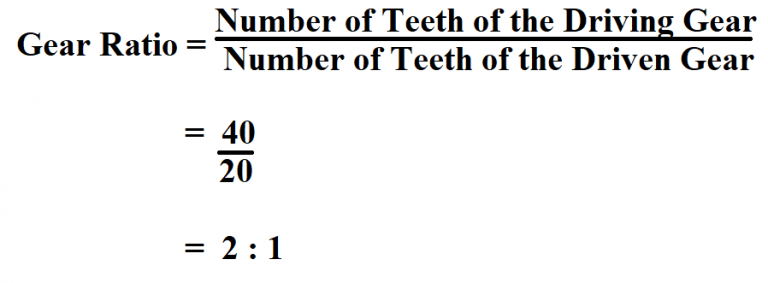

What Is the Gearing Ratio? Formula & Calculation

Similarly, if the business raises loans and purchases assets, it’s not a bad deal, and the business can be attractive from an investment point of view. However, if the business has better profitability, higher gearing is acceptable. This situation can be better assessed by calculating a ratio called time interest. A connective analysis of the profitability and gearing suggests that the business’s profit is sufficient to cover the interest cost. Suppose the debt and equity in the financing structure of the business amount to $20,000 and $15,000, respectively.

- Said another way, this ratio expresses the ratio of a company’s debt to equity or funds from shareholders.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- The ratio, expressed as a percentage, reflects the amount of existing equity that would be required to pay off all outstanding debts.

- For instance, if the business has obtained a loan to finance the project with a higher rate of return, the gearing is good.

In this regard, a company’s creditworthiness and general financial stability are significantly influenced by its gearing ratio. Please note that the use of debt for financing a firm’s operations is not necessarily a bad thing. The extra income from a loan can help a business to expand its operations, enter new markets and improve business offerings, all of which could improve profitability in the long term.

In addition, it is calculated by subtracting a company’s total liabilities from its total assets. A higher gearing ratio indicates that a company has a higher degree of financial leverage. It’s more susceptible to downturns in the economy and the business cycle because companies that have higher leverage have higher amounts of debt compared to shareholders’ equity. Entities with a high gearing ratio have higher amounts of debt to service. Companies with lower gearing ratio calculations have more equity to rely on for financing.

Raising capital by continuing to offer more shares would help decrease your gearing ratio. For example, if you managed to raise $50,000 by offering shares, your equity would increase to $125,000, and your gearing ratio would decrease to 80%. While there is no set gearing ratio that indicates a good or bad structured company, general guidelines suggest that between 25% and 50% is best unless the company needs more debt to operate.

But as a one-time calculation, gearing ratios may not provide any real meaning. A gearing ratio is a measure of financial leverage, i.e. the risks arising from a company’s financing decisions. The Gearing Ratio measures a company’s financial leverage stemming from its capital structure decisions. They include xero accounting software review for 2021 the equity ratio, debt-to-capital ratio, debt service ratio, and net gearing ratio. A bad gearing ratio indicates an over-reliance on debt, exposing the company to higher financial risk and potential instability. Typically, a gearing ratio above 1 is considered high and potentially problematic.

- Как выбрать надежное казино с СМС оплатой для ставок

- Лучшие онлайн казино Казахстана для больших выигрышей 2025

- Лучшие онлайн казино для честной игры без обмана 2025

- Лучшие клубы для высоких ставок в виртуальных казино 2025

- Fre slot Miss Red Spins Non Deposit Toeslag september 2024

- Tagesordnungspunkt Bingoseiten 2023: haul of hades Paypal Nachfolgende besten Erreichbar-Plattformen im Syllabus

- Real cash Ports On Da Vinci Diamonds Dual Play online slot line

- Pearl Lagoon Condition Comment 96 88% RTP Enjoy Letter Wade 2025

- 無料のゼロデポジットクリックと楽しむためのラインスロット上のオオカミ探求者

Bài viết cùng chủ đề:

-

The difference between the periodic and perpetual inventory systems

-

Cash Flow Statement: Operating, Investing & Financing Activities

-

How Salvage Value Is Used in Depreciation Calculations

-

What Is Salvage Value in Accounting and How Is It Calculated?

-

What is Fund Accounting? A Nonprofit’s Guide

-

How to Comply with Accounting Standards for Nonprofits

-

Liability: Definition, Types, Example, and Assets vs Liabilities

-

All About Liabilities: Meaning, Types and Examples

-

California Overtime Law 2025: All You Need to Know

-

Accounting Explained With Brief History and Modern Job Requirements

-

Contribution Margin Formula + Calculator

-

Contribution Margin: Definition, Overview, and How To Calculate Online Business School

-

What is Prepaid Insurance: Benefits and Examples Order to Cash Knowledge Center

-

Prepaid Expenses: Definition, Examples & How to Record

-

Cash Basis vs Accrual Accounting: Which Method Is Right for Your Business? PW Associates, CPAs

-

Cash Basis of Accounting: Definition, Example & Key Differences